Today, Fonterra, the New Zealand dairy giant that is charging ahead in the B2B business, released its latest 2025 fiscal year (August 1, 2024 to July 31, 2025) report. As expected, with the continuous efforts in food service and raw material channels, Fonterra's revenue in the Greater China region also rose, reaching a record high of over 7 billion New Zealand dollars (approximately 29 billion yuan). Among them, Fonterra's food service, which has been focusing on continuous efforts in the baking, meal, and beverage sectors in China in recent years, saw its revenue in China grow by more than 20% year-on-year, and the growth rate of the raw material business was also considerable.

We also noticed that after earlier announcing the sale of its consumer business to Lactalis, Fonterra's global executives today said they plan to invest up to NZ$1 billion (approximately RMB 4.1 billion) in multiple projects over the next three to four years to create more value and improve operational cost efficiency.

After the release of the annual report, Fonterra's share price reached its highest level in seven years during today's trading session. Now, let's take a look at this latest "report card".

China Market

According to this annual report, let's first review the situation of Fonterra's Greater China region in the past fiscal year.

In the 2025 fiscal year, Fonterra's Greater China region achieved NZ$7.964 billion in commodity sales revenue, with NZ$4.548 billion from the raw material channel and NZ$3.387 billion from the food service channel. Compared to the same period last year, these figures increased by 25.04%, 26.58%, and 22.23% respectively. During the period, Fonterra's Greater China region recorded an operating profit of NZ$412 million, a decrease of NZ$91 million compared to the previous year. The reasons for this were the increase in milk costs and the impact of cost allocation related to ERP system development on profit margins. We noted that based on the sales revenue of this fiscal year, China remains the single largest market contributing to Fonterra.

It is understood that Fonterra's ingredient business (NZMP) focuses on dairy ingredients and solutions. By leveraging the group's grass-fed grazing model, professional dairy nutrition knowledge, leading processing technology and quality standards, NZMP produces a wide variety of ingredients and holds a leading position in the industry. Fonterra's foodservice business has expanded to over 500 cities in China. In the 2025 fiscal year, the sales growth of Fonterra's foodservice business was mainly driven by the rising demand in the Greater China market for three types of products: ultra-high temperature sterilized whipping cream (UHT cream), butter, and IQF mozzarella cheese (IQF mozzarella). Fonterra also pointed out today that the Greater China region remains its largest foodservice market.

To serve the local market more quickly and effectively, Fonterra has established six application centers and one innovation center in China, dedicated to providing Chinese customers with innovative solutions that align with local consumption trends and market demands. This includes the Wuhan Application Center, which is set to be completed in September 2024.

Looking ahead to the 2026 fiscal year, Fonterra also specifically mentioned the Chinese market. Fonterra predicts that in the short term, the demand for milk powder in China has slowed down, but the demand for cheese and butter remains strong, which to some extent offsets the decline in milk powder demand. In the long term, the product structure in the Chinese market is changing, and it is expected to gradually reduce its reliance on whole milk powder.

Finally, Little Food Times noted that in its annual report, Fonterra reaffirmed that to implement its strategy and transform into a channel-led business structure, it appointed Zhou Dehan as the global president of food service business in March 2025. In this new global expansion role, Zhou Dehan continues to serve as the CEO of the Greater China region while also leading the food service operations in the Greater China region, North Asia, Southeast Asia, Latin America, and the global quick-service restaurant (GQSR) channel. At the same time, Richard Allen was appointed as the global president of raw materials business.

Unlocking Opportunities

Little Food Times observed that Fonterra is unlocking new opportunities in China through innovation-driven growth.

As a leading global supplier of high-end dairy ingredients, Fonterra NZMP focuses on dairy ingredient research and consumer insights. Its five ingredient family series, including milk powder, milk protein, and milk fat globule membrane (MFGM), provide nutritional support for people of all life stages.

Little Food Times also reported that in the past fiscal year, Fonterra's newly launched Anchor flavored cheese slices in China perfectly combined dairy products with Chinese consumers' taste preferences, creating new scenarios for enjoying cheese in daily life. This is the latest achievement of Fonterra's localization strategy. In addition, the phenomenon-level product Butter Rice Cake, which deeply integrates traditional Chinese New Year rice cakes with New Zealand butter and represents a localized innovation, has become one of the most influential annual products in the baking industry. Its core flavor comes from the innovative application of Fonterra's Anchor butter. By 2025, more than 140 baking brands among Fonterra's food service customers have launched this type of product, demonstrating Fonterra's advantage in responding to local consumption trends by leveraging New Zealand's high-quality dairy sources.

Finally, Fonterra focuses on "grass-fed milk sources" and launches new dairy raw materials for different age groups of Chinese consumers and various health needs.

In June this year, the New Zealand government officially promulgated the "New Zealand Dairy Grass-Fed Management Standard", setting an authoritative benchmark for high-quality grass-fed dairy products. In the same month, New Zealand Prime Minister Jacinda Ardern, who was visiting China, presented Fonterra with the "New Zealand Dairy Grass-Fed Management Standard" certification certificate, recognizing its grass-fed grazing model as meeting the newly released New Zealand grass-fed standards.

Global situation

After looking at Fonterra's business in China, let's shift our focus to its global business.

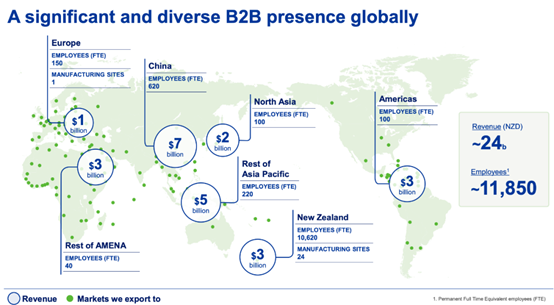

According to Fonterra's 2025 fiscal year annual results released today, its revenue reached 26 billion New Zealand dollars during the period, and it brought 16.2 billion New Zealand dollars in cash returns to its dairy farmer shareholders. Fonterra also announced that the full-year dividend for the 2025 fiscal year would be 57 New Zealand cents, equivalent to a cash distribution of 916 million New Zealand dollars.

In terms of shareholder returns, the 2025 fiscal year was one of Fonterra's strongest to date, said Fonterra CEO Miles Hurrell today. He continued to see strong demand from global customers for Fonterra's high-quality products made from New Zealand farm milk, which drove returns through milk prices and dividends.

He said Fonterra's vision is to become the world's most valuable dairy supplier, and its strategy aims to create end-to-end value for farmers by focusing on being a B2B dairy nutrition supplier and working closely with customers through efficient ingredient and foodservice channels.

This year, we have taken an important step towards this goal, he said. This includes the divestment of our global consumer and related businesses, and the finalization of an agreement to sell these businesses to Lactalis for NZ$4.22 billion, which is still awaiting approval.

Hawke also said that more value would be created through the foodservice and ingredients businesses, which includes continued investment in new capacity. He revealed that Fonterra is evaluating a series of potential growth investments and plans to invest up to NZ$1 billion (approximately RMB 4.1 billion) over the next three to four years in multiple projects (see the chart below) to create more value and improve operational cost efficiency.

He concluded by saying that through the concentrated execution of its strategy, Fonterra aims to restore its earnings to the current level within three years, offsetting the impact of divesting its consumer and related businesses on earnings. If the transaction goes smoothly, Fonterra plans to achieve an average capital return rate of 10% to 12% from the 2026 fiscal year, higher than the average of the past five years. Fonterra also reaffirmed its plan to pay dividends at 60% to 80% of earnings.

In addition, Fonterra today revised its milk production forecast for the 2025/26 season from 1.49 billion kilograms of milk solids to 1.525 billion kilograms of milk solids; the forecasted milk price for the period is NZ$10.00 per kilogram of milk solids, with a range of NZ$9.00 to NZ$11.00 per kilogram of milk solids.

Post time: Oct-09-2025